KOSPI Breaks 5000 for First Time in History - A New Era for Korean Markets

January 22, 2026.

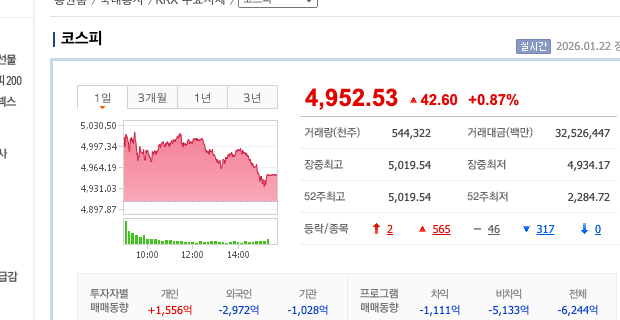

KOSPI broke 5000.

A first in 70 years of Korean stock market history.

At 9:03 AM, just one minute after opening, it hit 5002.09.

4000 to 5000 in Just 3 Months

Looking back at KOSPI's journey:

| Index | First Breach | Time Taken |

|---|---|---|

| 1000 | April 1989 | - |

| 2000 | July 2007 | 18 years |

| 3000 | January 2021 | 14 years |

| 4000 | October 2025 | 4 years 9 months |

| 5000 | January 2026 | 3 months |

It took 4 years and 9 months to go from 3000 to 4000,

but only 3 months from 4000 to 5000.

What happened?

Semiconductors Led the Charge

The answer is semiconductors.

Samsung Electronics: +125% in 2025, +24% in 2026

SK Hynix: +274% in 2025, +13% in 2026

Combined market cap: ₩1,424 trillion.

Nearly 40% of total KOSPI market cap.

AI datacenter investment boom → HBM demand surge → Memory price rise

This formula powered the Korean market.

Hyundai's Robotics Rally

It wasn't just semiconductors.

After Hyundai unveiled its humanoid robot 'Atlas' at CES 2026,

its stock surged 77.2%.

Samsung Electronics, SK Hynix, and Hyundai Motor.

These three stocks accounted for 52% of KOSPI's market cap gains this year.

Korea Discount Narrowing?

The Lee Jae-myung administration's 'KOSPI 5000' initiative helped.

Stricter penalties for market manipulation

Mandatory treasury stock cancellation

Encouraging higher dividends

Easing foreign investment regulations

The long-standing 'Korea Discount' appears to be gradually narrowing.

70 Years of Market History

When the Korea Stock Exchange opened in 1956:

Listed companies: 12

Market cap: ₩15 billion

Today in 2026:

Listed companies: 2,659 (KOSPI 843 + KOSDAQ 1,816)

Market cap: ₩4,518 trillion (KOSPI + KOSDAQ)

Market cap has grown 300,000x in 70 years.

Any Overheating Concerns?

Of course.

Top 3 stocks account for 52% of market cap gains

Some analysts say we're in technical overheating territory

Debate over semiconductor cycle peak

However, brokerages keep raising targets:

| Firm | KOSPI Target |

|---|---|

| SK Securities | 5,250 |

| Kiwoom Securities | 3,900~5,200 |

| Korea Investment | 5,560 |

The consensus is there's still room to run.

My Take

Honestly, 1000 points in 3 months is a bit scary.

But looking at the bigger picture:

AI infrastructure investment continues for 2-3 more years

Korea is #1 in memory semiconductors globally

Value-up policies are establishing shareholder return culture

Short-term corrections may come,

but the medium to long-term direction still points up.

Conclusion

KOSPI 5000.

Just a few years ago we wondered "when will we see 3000 again?"

Now we're talking about 6000.

A new chapter in Korean market history has begun.

Recording this moment.

※ This is not investment advice. All investment decisions and responsibility are your own.