Samsung Electronics Stock Outlook 2026 - Path to $70B Operating Profit

Samsung Electronics is on fire.

Q4 2025 Operating Profit: ₩20 trillion (~$14 billion USD).

This beats the 2018 memory super-cycle record (₩17.5T) after 7 years.

And for 2026, analysts are forecasting operating profit over ₩100 trillion (~$70B).

Q4 2025 Results Summary

Samsung's preliminary Q4 2025 results announced on January 8th:

| Metric | Q4 Result | QoQ | YoY |

|---|---|---|---|

| Revenue | ₩93T | +8.06% | +22.71% |

| Operating Profit | ₩20T | +64.34% | +208.17% |

Operating profit more than tripled year-over-year.

The result of surging memory prices and favorable exchange rates.

What's Driving This?

1. Memory Price Surge

DRAM prices have skyrocketed.

PC DRAM (DDR4 8Gb): $1.35 (end of 2024) → $9.30 (end of 2025)

6.9x increase in one year

32.9% jump in Q4 alone

Explosive AI server demand has created HBM shortages,

pulling up conventional memory prices as well.

2. Exchange Rate Tailwind

The KRW/USD rate exceeded 1,400,

boosting dollar-denominated semiconductor exports.

3. HBM Ramp-up

After trailing SK Hynix in the HBM market,

Samsung is finally shipping volume.

2026 Outlook: The ₩100T Club?

Analyst estimates keep rising.

| Firm | 2026 Operating Profit Estimate |

|---|---|

| Kiwoom Securities | ₩128.7T |

| IBK Investment | ₩133.3T |

| FnGuide Consensus | ₩85.4T |

Conservative estimates point to ₩85T, bullish ones to ₩130T+.

Either way, it's record-breaking territory.

HBM is the Key

Samsung's projected 2026 HBM revenue growth rate: 105%.

Samsung: +105%

SK Hynix: +14%

Micron: +33%

The reason for this massive outperformance?

HBM4 mass production.

Samsung recently completed HBM4 internal qualification testing (PRA).

PRA completion confirms yield and performance targets are met.

Once HBM4 volume shipments begin in 2026,

Samsung can reclaim market share lost to SK Hynix.

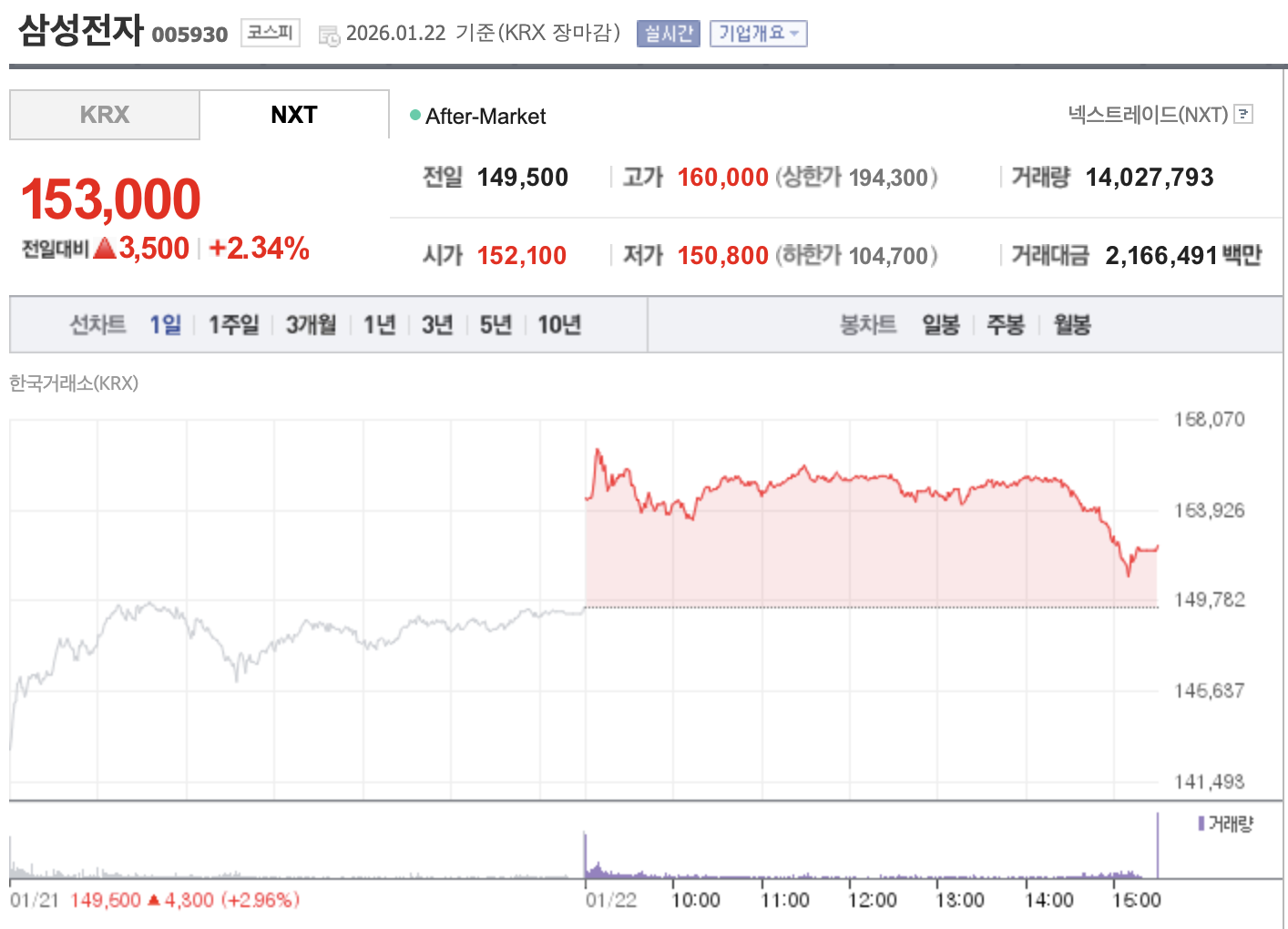

Price Targets

Analyst price targets summary:

| Firm | Target Price | Upside |

|---|---|---|

| Hana Securities | ₩155,000 | +11% |

| IBK Investment | ₩155,000 | +11% |

| KB Securities | ₩160,000 | +15% |

| SK Securities | ₩170,000 | +22% |

| Morgan Stanley | ₩175,000 | +26% |

| Some analysts | ₩200,000 | +44% |

From the current price of ~₩139,000,

most targets fall in the ₩150,000-200,000 range.

What Are the Risks?

There are some.

HBM Competition: SK Hynix still leads, Micron is catching up

Memory Cycles: No boom lasts forever. Potential correction after 2027

Foundry Struggles: Non-memory business still underperforming

Geopolitical Risks: US-China chip war implications

However, AI infrastructure investment looks set to continue for 2-3 more years,

suggesting the memory boom has legs.

Should You Buy Now?

My personal take:

Short-term: High ₩130,000s feels stretched. Consider buying on dips

Medium-term: 2026 earnings momentum is solid. ₩150,000+ looks achievable

Long-term: Core AI beneficiary. Hold if you can stomach volatility

Below ₩130,000 looks like an accumulation zone,

above ₩150,000 consider taking some profits.

Conclusion

Samsung Electronics is finally riding a proper cycle.

HBM4 production, AI semiconductor super cycle, memory price surge.

2026 could be a record-breaking year for Samsung.

Of course, stocks price in the future,

so current prices already reflect significant expectations.

But a company approaching ₩100 trillion in operating profit

trading at less than 10x P/E? I'd argue it's still undervalued.

※ This is not investment advice. All investment decisions and responsibility are your own.